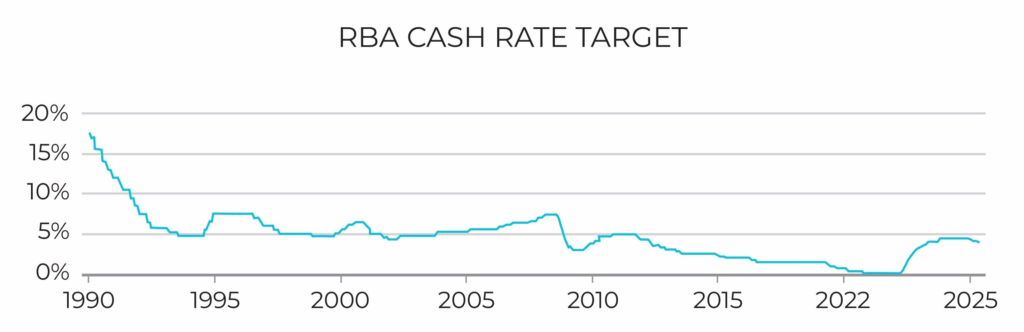

The Reserve Bank’s recent decision to cut rates by 0.25 percentage points was big news. This newsletter looks into how lenders have responded and shares some other significant stories.

- Lenders cut interest rates

- Borrowers embracing refinancing

- Quick guide to ALP housing promises

- Property prices set new record

Read more below.

More than 65 lenders, including the big four banks, have cut their interest rates following the Reserve Bank of Australia’s decision to reduce the cash rate from 4.10% to 3.85%.

This will mean lower repayments for the typical variable-rate borrower – although the size of the rate cuts, and the dates at which they’re taking effect, is varying from lender to lender.

Here are three tips to bear in mind in this downward interest rate environment:

- Think about refinancing. If your lender is not making the right competitive moves with your interest rate, I can compare the market for you and search for better options.

- Review your new borrowing power. Lower interest rates can increase how much you can borrow, which may open up new opportunities to upsize, renovate or invest. Just be careful not to overextend yourself.

- Use your savings wisely. Consider what you do with the money you save with a lower rate. Splurging on treats may be satisfying, but investing the money, making extra repayments on your loan or building the balance in your offset account may be a smarter long-term option.

Confused about your loan options? Let’s chat

Market commentators are expecting a big jump in refinancing activity in the coming weeks, given that numerous borrowers switched home loans earlier in the year following the previous cash rate cut, in February, by the Reserve Bank of Australia.

Equifax, a credit reporting agency, has reported that the number of mortgage applications in the first quarter of 2025 was 5.2% higher than the same quarter the year before. Refinancers played a major role in that increase, with refinancing accounting for 37% of mortgage demand in the month of March.

3 key things to consider before refinancing your home loan:

- Review your financial position. Confirm you have enough equity in your property, a large enough income and a strong enough credit score to qualify for a new home loan. Also, make sure refinancing aligns with your goals, whether that’s reducing your repayments, conducting a debt consolidation or ‘cashing out’ equity (e.g. to fund renovations).

- Do a cost-benefit analysis. Make sure the savings you would get from switching home loans would exceed the costs, which may include discharge fees, break fees, application fees and lenders mortgage insurance.

- Take a holistic view. When comparing loan options, it’s important to look beyond the rate, because the lowest-rate loan won’t always be the most suitable option for you. That’s why you should also consider things like loan features and repayment flexibility.

Now that Anthony Albanese has started his second term as prime minister, there has been renewed focus on the housing policies the Australian Labor Party (ALP) took to the election.

From 2026, the ALP promised to make the Home Guarantee Scheme available to all first home buyers; currently, it is limited to 50,000 places per year and includes income caps. “There will be no caps on how many people can apply and no limit on how much you or your partner can earn. For first home buyers, you’ll be able to buy an eligible property anywhere in Australia, with a deposit as low as 5%,” according to the ALP.

To increase the supply of housing – and thereby put downward pressure on prices – the ALP promised to invest $10 billion to build up to 100,000 homes reserved only for first home buyers. “Funding will support enabling infrastructure, land purchases or construction to get these homes built – near work and family, only for first home buyers,” Labor said.

Labor also promised to invest an additional:

- $120 million to incentivise states to remove red tape and help more homes be built faster

- $78 million to fast-track the qualification of 6,000 tradespeople and thereby increase the residential construction workforce

- $54 million to support the advanced manufacturing of prefabricated and modular homes, which can be built up to 50% faster than traditional homes

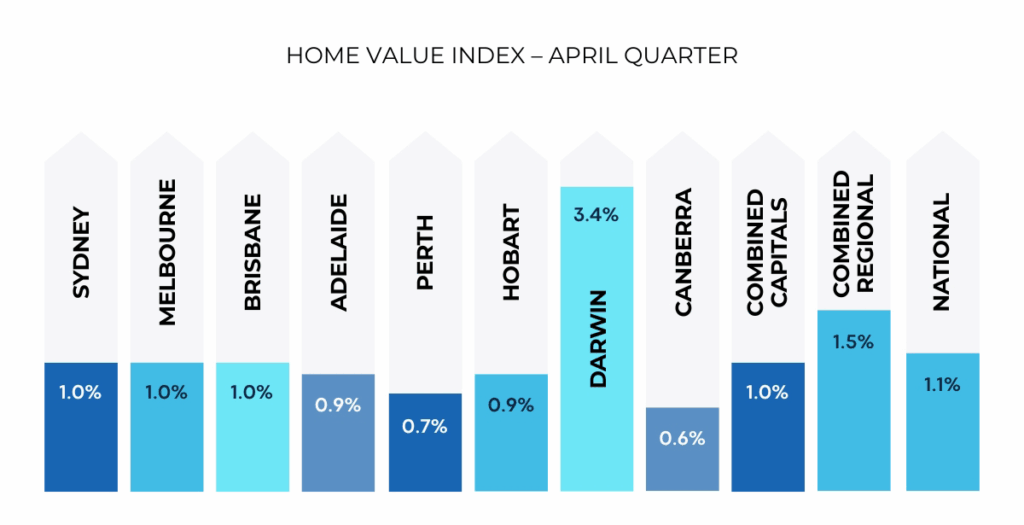

Australia’s median property price rose 1.1% during the three months to April, to reach a new peak of $825,349, according to Cotality.

Every capital city recorded growth during that three-month period, ranging from 0.6% in Canberra to 3.4% in Darwin.

Cotality’s analysis also revealed:

- Regional property prices rose faster than metro prices during the April quarter (1.5% vs 1.0%)

- House prices rose faster than unit prices (1.2% vs 0.7%)

- Three capital cities recorded record-high median prices (Brisbane, Perth, Adelaide)

Property prices have recorded strong growth in recent decades, despite occasional downturns. So although prices are elevated in many parts of the country, they might get even higher in the years ahead. If you’re thinking about entering the market, it might be wise to consider taking action sooner rather than later.