I hope you have a strong finish to the 2024-25 financial year. In this month’s newsletter, you’ll find a mix of economics, tax, vehicle and property news:

- Businesses facing mixed conditions

- Time running out for tax break

- Car market changes gear

- Hotel investment heats up

Read more below.

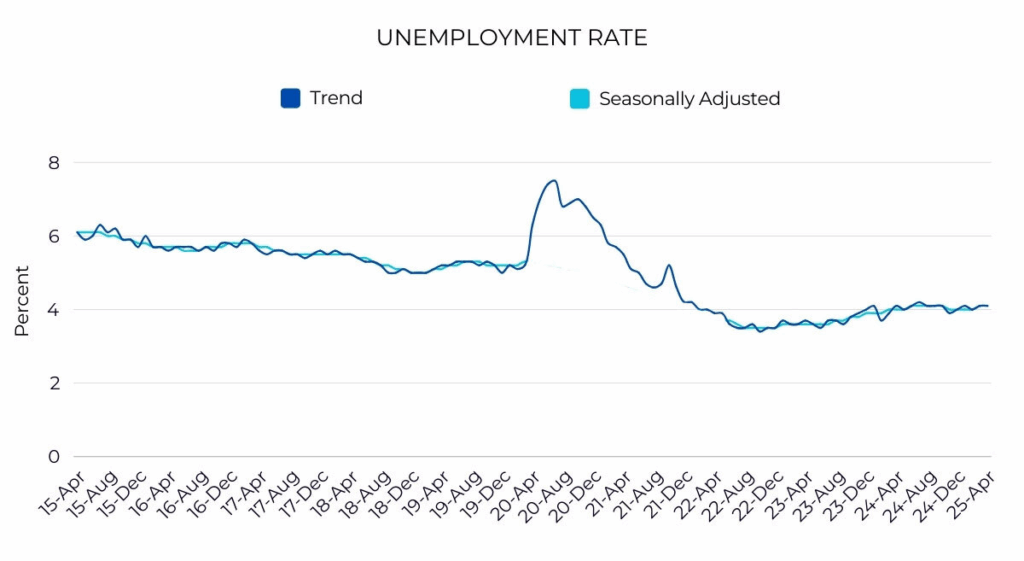

Businesses are facing mixed conditions, with the labour market remaining tight but with household spending rising in real terms, according to the latest data from the Australian Bureau of Statistics.

The unemployment rate in April was 4.1%, which was unchanged from both the month before and year before. Despite the weak economy, there is little slack in the labour market, which means employers face competition to attract and retain quality staff.

In better news, household spending rose 3.5% year-on-year in the March quarter, while prices rose 2.4%. That means, for the average business, business revenues should be outpacing cost increases.

With the new financial year just around the corner, here are five ways to become more profitable in 2025-26:

- Review pricing regularly – Ensure your prices reflect rising costs and market demand

- Focus on customer retention – It’s cheaper to keep existing clients than win new ones

- Invest in staff training – Skilled employees are more efficient and productive

- Cut unnecessary expenses – Regularly audit overheads to find savings

- Embrace technology – Automation and digital tools can streamline operations and boost profits

The Australian Taxation Office (ATO) has released guidelines to help your business understand whether it’s eligible for the $20,000 instant asset write-off for the 2024-25 financial year.

“If your business has an aggregated annual turnover of less than $10 million and uses the simplified depreciation rules, you may be eligible to claim the instant asset write-off to immediately deduct the business part of the cost of eligible assets,” according to the ATO.

However, conditions apply:

- New and second-hand assets can qualify, although some exclusions and limits apply.

- Assets must be first used or installed ready for use for a taxable purpose between 1 July 2024 and 30 June 2025.

- The usual rules for claiming deductions still apply. You can only claim the business part of the expense, and you must have records to prove it.

The $20,000 limit applies on a per-asset basis, so you can instantly write off multiple assets as long as the cost of each asset is less than the limit.

With one month remaining in the financial year, please contact me immediately if you’d like to purchase an asset in FY25. Also, please speak to a tax professional to check your eligibility for the instant asset write-off.

Planning to buy an asset? I can help

A change to fringe benefits tax rules has triggered a sharp fall in plug-in hybrid electric vehicle (PHEV) sales, according to new industry figures.

The Federal Chamber of Automotive Industries (FCAI) reported that just 2,601 PHEVs were sold in April 2025, accounting for 2.9% of all new car sales – well below the 4.7% average over the previous 12 months. The drop came after the government removed the FBT exemption for these vehicles at the end of March.

FCAI boss Tony Weber said this highlighted how crucial consistent policy is for encouraging the take-up of low-emission vehicles. Battery electric vehicles made up 5.9% of April sales, which Weber described as modest given the new NVES rules encouraging cleaner cars.

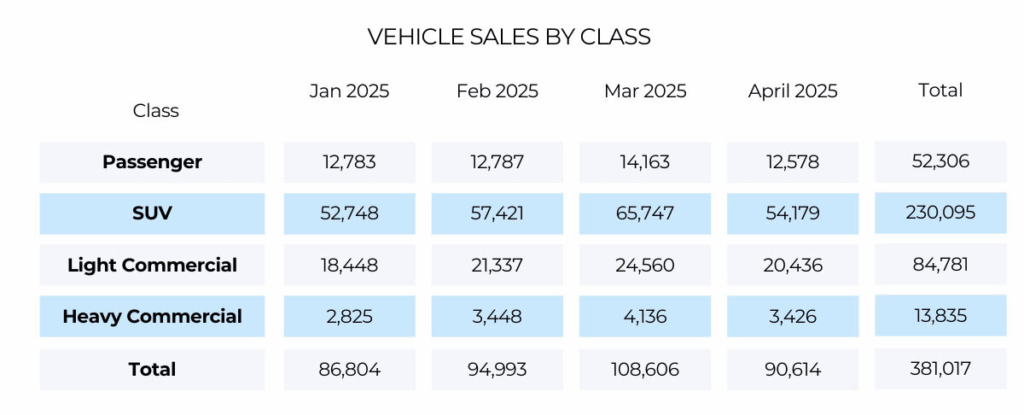

Total new vehicle sales in April fell 6.8% year-on-year, with 90,614 vehicles sold. Toyota topped the sales charts, followed by Ford and Mazda. The Toyota HiLux remained the country’s most popular model.

Please get in touch if you’re looking to buy a new company car and want help financing the purchase.

Reach out for a car loan pre-approval

Australia’s hotel investment market is showing renewed strength, with the first quarter of 2025 recording $791.8 million in transactions – more than double the same period last year. This sharp increase reflects growing investor confidence, driven by a strong recovery in international tourism and limited new hotel supply, according to Ray White Group head of research Vanessa Rader.

Although total hotel transaction volume over the past year dipped slightly (down 2.7% to $2.2 billion), investor interest remains high, especially from offshore buyers. Singapore continues to dominate foreign investment, with significant contributions from Canada and Thailand. Sydney and Melbourne remain the top destinations for capital, underpinned by marquee property sales.

“The compression in [capitalisation] rates continues, tightening 62 basis points to average 6.2%, reflecting increased competition for quality assets and growing investor confidence in the sector’s long-term performance,” Ms Rader said.

Contact me if you’re considering financing a commercial property purchase in this growing market.