This is going to be an interesting year, with a federal election just around the corner and a wave of policy announcements in the works. Here’s what’s making news right now:

- Businesses struggling to find staff

- Investors snapping up data centres

- Inflation and interest rates update

- Commercial property sector heating up

Read more below.

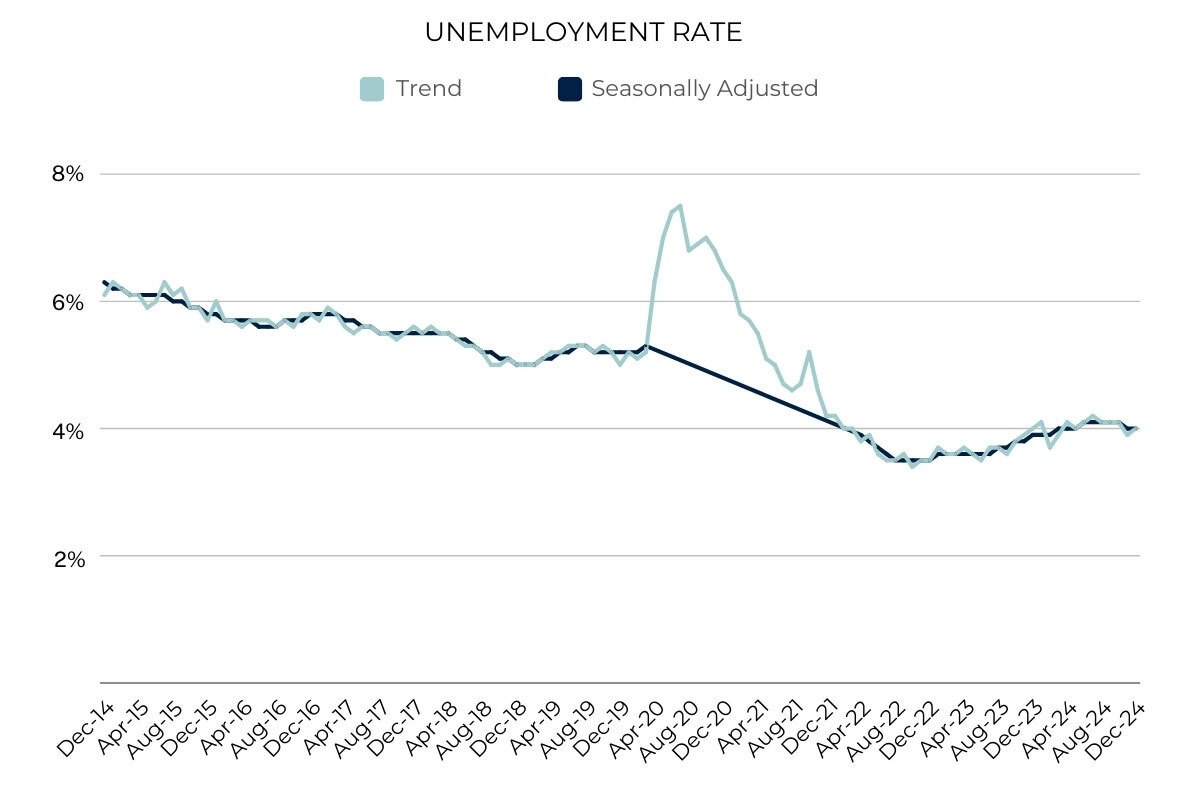

When the economy weakens, unemployment tends to rise, which means businesses find it harder to make sales but easier to find staff. Conditions, though, have turned out differently in the current slowdown.

On the one hand, the most recent data from the Australian Bureau of Statistics shows clear evidence of a slowdown, with business turnover falling 0.3% between October 2023 and October 2024. However, the most recent jobs data show the unemployment rate in December 2024 was exactly the same as the year before – 4.0%.

Furthermore, during the same period, the underemployment rate – which records the share of people who want to work more hours than they currently do – declined, from 6.6% to 6.0%. Also, the participation rate – which records the share of the working-age population who either have a job or want one – rose from 66.6% to a record 67.1%.

Taken together, these statistics illustrate the challenge facing businesses – it’s hard to find staff when most people who want to be in the workforce are already in it; most of those people already have a job; and most of those people don’t want any more hours.

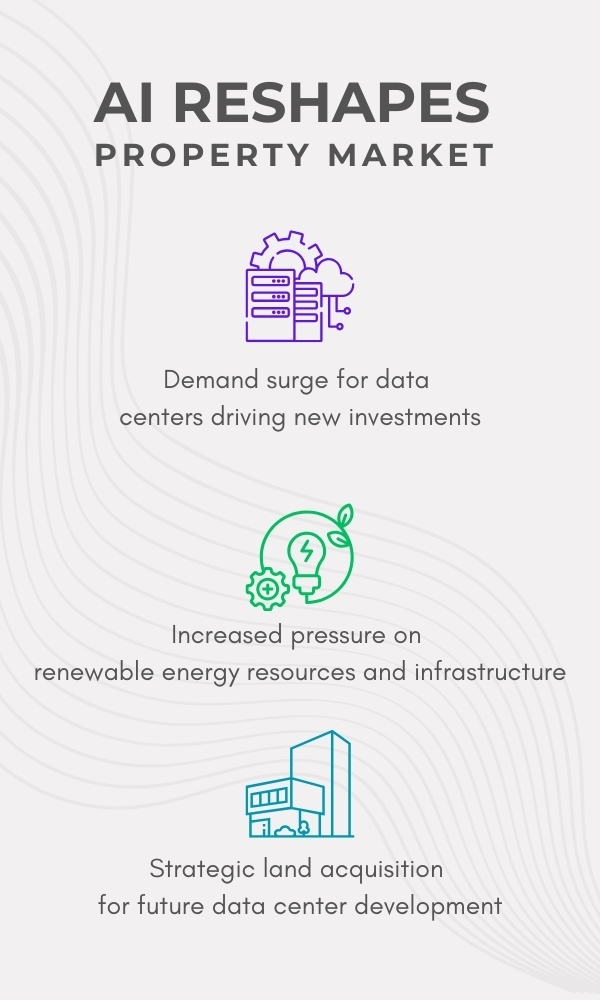

The rise of artificial intelligence will not only disrupt a range of industries – it will also have a significant impact on the commercial property market.

Multinational property group Savills has forecast that the rapid growth in AI will lead to more demand for data centres.

“This shift will put the spotlight on how the market navigates land and power constraints amid surging data centre demand. The rapid expansion of data centres will also prompt more investors to raise capital or seek out new equity sources for these investments,” according to Savills.

At the same time, there’s likely to be rising investment in the data centre pipeline, including physical sites.

“This demand will heighten pressure on renewable energy goals due to their substantial power requirements, and present significant opportunity for growth,” Savills said.

Savills has also forecast that institutional investors will deploy more capital towards data centres – and, with land at a premium, long-term investors will buy up land that could be used to develop data centres in the future.

Want to buy a commercial property? Call me for a loan

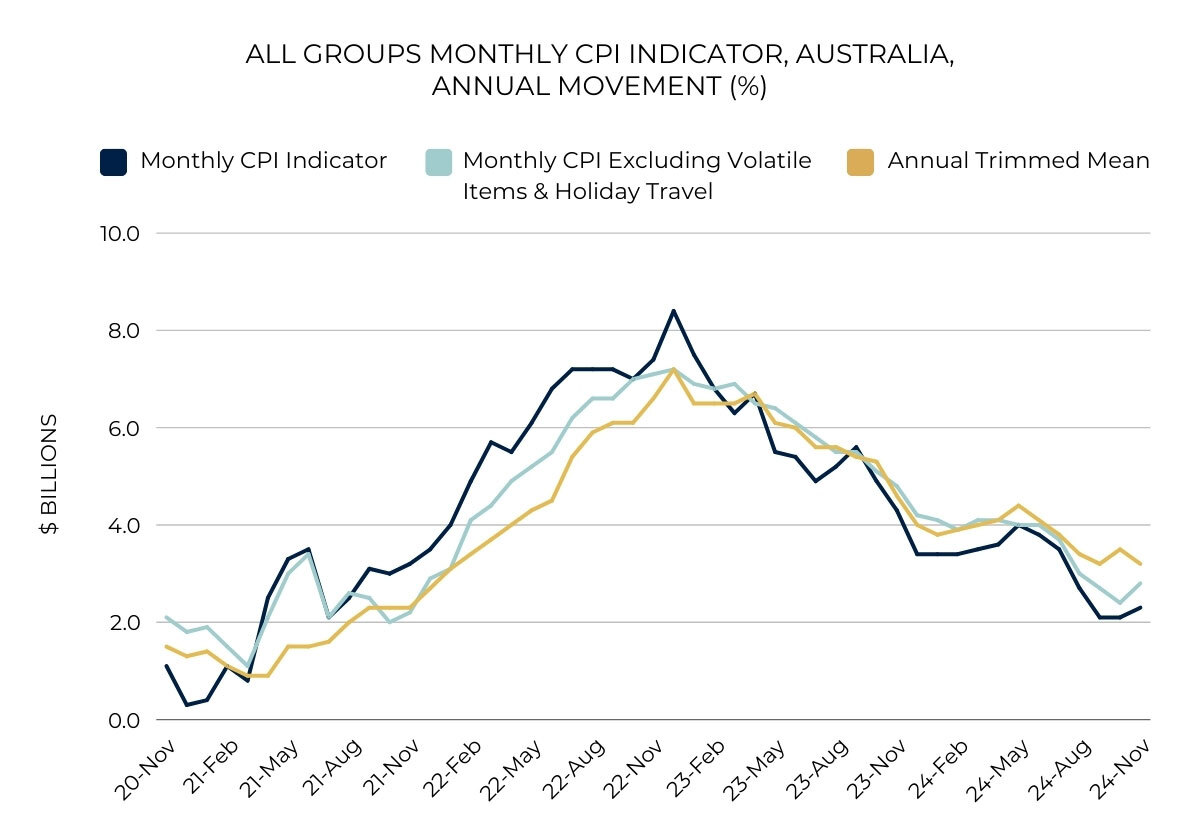

Annual inflation has now stayed under 3% for four consecutive months, according to the Australian Bureau of Statistics’ monthly inflation data, suggesting the Reserve Bank of Australia (RBA) is closing in on its goal to “sustainably” reduce inflation to its target range of 2-3%.

However, while headline inflation has fallen below 3%, underlying inflation – which excludes volatile items from price calculations – remains above 3%.

When the RBA board held its most recent monetary policy meeting in December, board members felt underlying inflation “was still too high”, according to the minutes. The minutes also noted that the RBA’s most recent forecasts “did not see inflation returning sustainably to the midpoint of the target until 2026”.

Furthermore, board members agreed that “monetary policy would need to be sufficiently restrictive until members are confident that inflation is moving sustainably towards target”.

As a result, the outlook for inflation – and interest rates – remains uncertain.

The commercial property market is showing signs of recovery, although market conditions remain mixed across different sectors and locations, according to Ray White Group head of research Vanessa Rader.

“Transaction momentum is building, particularly evident in the sub-$20 million market where both investors and owner-occupiers remain active,” she said.

“While larger institutional transactions have started to improve we are expecting to see more activity this year and early signs suggest offshore capital is regaining its appetite for Australian assets.”

“The Australian dollar trading below USD 0.70 creates an attractive entry point for international investors, effectively offering a significant discount on asset prices compared to other gateway cities globally.”

Ms Rader said population growth would also place upward pressure on commercial property demand.

“This demographic driver, combined with limited new supply across most sectors, should support occupancy levels through 2025,” she said.

“While challenges remain, particularly around debt costs and yield spreads, several indicators suggest improving conditions for commercial property investment. Success will likely favour assets with strong fundamentals, clear value-add potential and alignment with demographic trends.”

I wish you and your business every success in 2025. Please get in touch if you have any lending or refinancing enquiries.