While all eyes on the Reserve Bank’s cash rate decision on February 18, there were also some other important stories in the news recently:

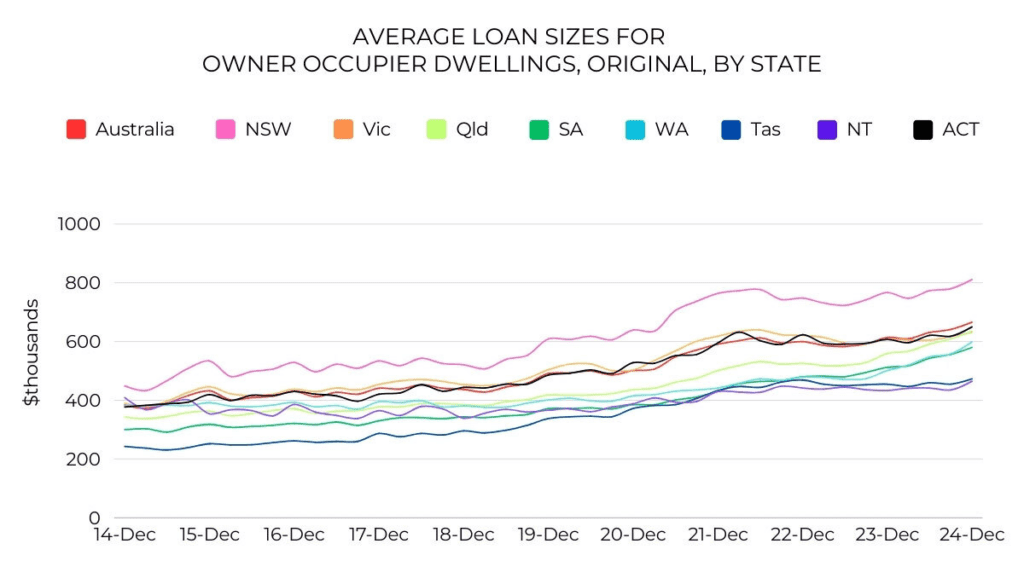

- Average loan sizes in each estate

- Foreign investors banned from buying existing homes

- Mortgage reprieve for young borrowers

- More consumers purchasing cars

Read more below.

Owner-occupiers are stepping up in the property market as investors are stepping down, according to new data from the Australian Bureau of Statistics, while average loan sizes now range from $465,000 in the Northern Territory to $811,000 in New South Wales.

During the final three months of the year, loan commitments fell 4.5% quarter-on-quarter for investors while rising 2.2% for owner-occupiers, reflecting a changing dynamic in the market.

Meanwhile, the average mortgage across Australia reached a record $666,000 at the end of 2024, an increase of 8.5% on the year before.

Given those large loan sizes, accumulating a deposit can be hard. So here are five things you can do to either save your deposit faster or reduce the size of the deposit required:

- Ask me about borrowing strategies that require less than a 20% deposit

- Speak to your parents about a guarantor home loan, which could potentially reduce your share of the deposit to 5% or even 0%

- Consider buying in conjunction with a partner, relative or friend

- Research the Home Guarantee Scheme, which lets eligible buyers purchase a property with just a 5% deposit without having to pay lender’s mortgage insurance

- Increase your savings rate, by looking for opportunities to cut your spending and grow your income

The federal government has announced plans to ban foreign investors from buying established homes and to crack down on illegal land banking, in an effort to cool demand and increase supply.

Foreign investors need to apply for approval before purchasing residential real estate in Australia. Under the current rules, they’re generally restricted to buying new properties although they are allowed to buy established properties under certain circumstances. Under the new rules, they will be banned from buying established properties between 1 April 2025 and 31 March 2027; a review will then be conducted to decide whether to continue the ban.

The government will also take action against foreign investors who buy vacant land, sit on it and then sell it for a profit, rather than following the regulations that require them to put the land to productive use within reasonable timeframes. To enforce the policy, the government will provide funding to the Australian Taxation Office to do more auditing and compliance work with foreign investors.

“This is all about easing pressure on our housing market at the same time as we build more homes,” Housing Minister Clare O’Neil said.

“These initiatives are a small but important part of our already big and broad housing agenda which is focused on boosting supply and helping more people into homes.”

Treasurer Jim Chalmers has instructed financial regulators to make it easier for Australians with student debt to take out a mortgage.

Currently, the banking regulator, APRA, and the financial services regulator, ASIC, expect lenders to take HELP-HECS debt into account when assessing home loan applications. However, Dr Chalmers said he wanted lenders to be able to exclude student debt repayments from serviceability assessments when they expected the borrower to pay off the debt in “the near term”, the Australian Financial Review reported.

“I’ve agreed these changes in discussions with regulators and convened the banks to discuss them,” Dr Chalmers said. “People with a HELP debt should be treated fairly when they want to buy a house and we’re working with the regulators to make sure they are.”

While Dr Chalmers has not indicated when these changes would take effect, if you contact me, I can calculate how much you can borrow now and estimate how much you might be able to borrow under the new rules.

Want to know your borrowing power? I can help

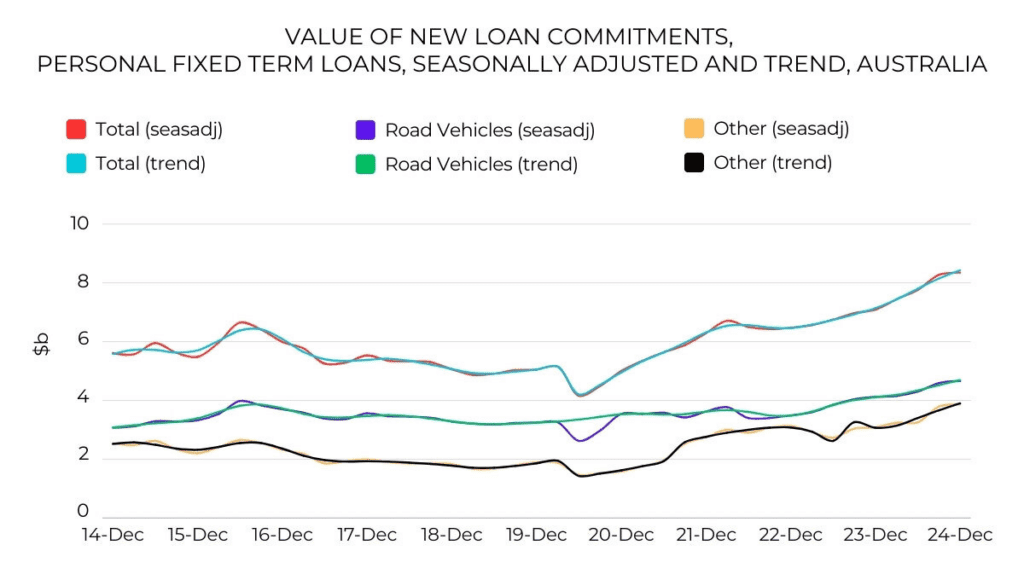

There was a sharp rise in the number of consumers taking out car loans in 2024, as motorists purchased a record number of new vehicles.

Australians bought an unprecedented 1,220,607 new vehicles last year, with Toyota, Ford, Mazda, Kia and Mitsubishi being the most popular brands, according to the Federal Chamber of Automotive Industries.

As a result, consumers took out a record $4.7 billion of car loans in the December quarter, which was 13.0% more than the year before, according to the Australian Bureau of Statistics.

Interestingly, there was an even larger rise in personal loans taken out to purchase holidays, household goods and other items – that rose by 25.9% to a record $3.9 billion.

If you’re looking to secure funds for a car or a consumer purchase, please get in touch, as a car loan or personal loan may be a better option than a credit card.

It’s a pleasure to bring you the news every month. I’m also here to help if you want to buy a property, purchase a vehicle or refinance a loan.