In this month’s newsletter, you’ll find an interesting blend of stories about finance, tax and the economy:

- Inflation falls but outlook uncertain

- Business optimism inching higher

- ATO targets tax scams and phoenixing

- How to qualify for a business loan

Read more below.

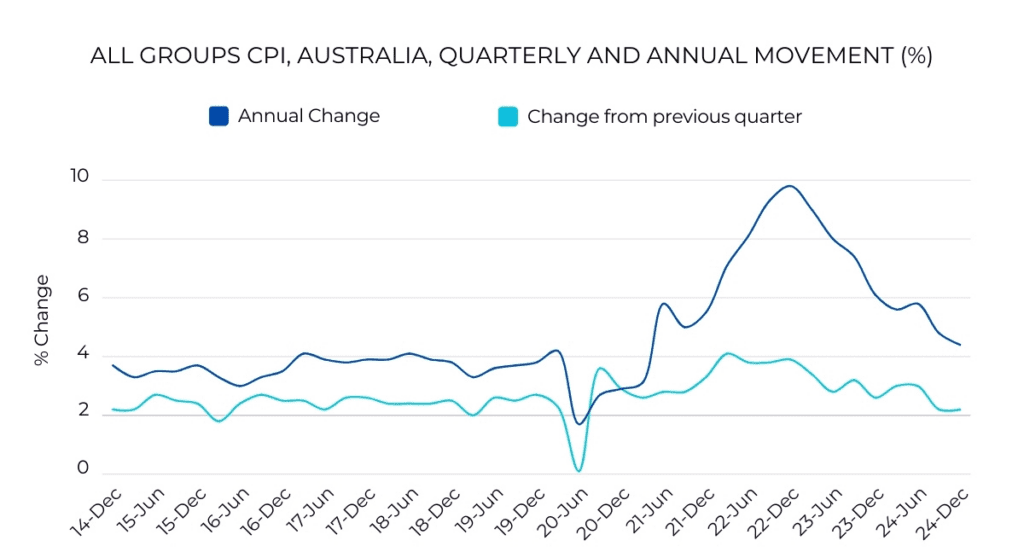

Inflation continues to move in the right direction, ushering in the possibility of lower prices growth, wages growth and interest rates in the near future.

Annual inflation fell from 2.8% in the September 2024 quarter to 2.4% in the December quarter. That marked the seventh decline in eight quarters, since inflation peaked at 7.8% in December 2022, according to the Australian Bureau of Statistics.

However, it remains to be seen if inflation will remain within the 2-3% target range pursued by the Reserve Bank of Australia (RBA).

It’s possible inflation will rise again. During the RBA board’s monetary policy meeting in December, members noted “there was still excess demand in the Australian economy” and “persistently high services price inflation”, according to the minutes.

Conversely, it’s conceivable inflation will fall below the target range, due to a possible combination of even slower economic growth and rising unemployment, which would restrain wages growth and consumer spending.

An analysis of business conditions by CreditorWatch chief economist Ivan Colhoun suggests that while the economy is struggling now, better times lie ahead.

“The overall level of business conditions experienced over the past three months hasn’t changed much in recent quarters, but remains considerably weaker than the mostly very favourable conditions experienced by many but not all firms over the COVID period,” he said.

“Interestingly, while current and near-term expected conditions have been easing, firms’ expectations about the next twelve months have remained pretty solid and improved this quarter [December].”

Regarding expected conditions over the next three months:

- The least optimistic sectors are retail, mining and manufacturing

- The most optimistic are recreation & personal services, finance, transport and property & business services

Meanwhile, the latest data from the Australian Bureau of Statistics has confirmed there were 2,662,998 actively trading businesses in the economy at the end of June 2024.

That was 2.8% higher than the year before, due to a 16.8% entry rate and 14.0% exit rate.

Want to expand? Call me for a loan

“Potentially dodgy tax schemes are being promoted online and offered to people when they least expect it,” according to the Australian Taxation Office (ATO).

“We’re urging businesses of all sizes to be wary of offers of schemes promising to significantly reduce or avoid tax. Many scheme promoters claim they can help you reduce or avoid paying tax in return for the payment of fees. Once you’ve paid, the promoter disappears and you could face heavy penalties for getting involved in a dodgy tax scheme,” the ATO said.

“Recently, we’ve seen one tax scheme encouraging people to dodge their taxes by setting up a purported not-for-profit foundation and organising their finances to look like their income belongs to the foundation. Another recent scheme is offering an investment opportunity into a start-up company.”

Both schemes are too good to be true, but “have the potential to entice honest people and businesses if they commit before doing their research first”.

Meanwhile, the ATO is also cracking down on ‘phoenixing’, or the practice of illegally continuing a company that has been liquidated or abandoned to avoid paying debts.

“The government announced an extension and enhancement of funding for us to continue to build on our existing work to combat illegal phoenix activity. The economic impact of illegal phoenix activity on business, employees and government is estimated to be $4.89 billion annually,” the ATO said.

Securing a business loan can be challenging, but there are steps you can take to become more creditworthy.

Strengthen your finances. Try to make your cash flow and revenue as reliable and stable as possible. If your financials are volatile, consider timing your loan application for when your business is going through a better period.

Offer security. While some lenders are willing to issue unsecured loans, you’ll have more options if you provide security in the form of property, equipment or a personal guarantee.

Keep accurate financial records. Ensure your tax returns, balance sheet and P&L statements are up to date. This will make it easier to prove your financial health and your ability to meet loan repayments.

Establish a strong credit history. Check both your business and personal credit scores ahead of time, so you can fix any incorrect negative listings and identify room for improvement. The lower your liabilities and the more consistent your repayment record, the more creditworthy you’ll appear.

Work with a business finance expert. As your broker, I can structure your loan and present your application in a way that maximises your chances of approval.

I can help you get a business loan

Thank you to all my loyal clients. I’m always here to help, whether you want to fund an investment, refinance a loan or discuss your future plans.