The federal election has been dominating the media recently, but there have also been some other important business and economics stories making the news:

- Job vacancies down 30.7% from peak

- Mixed news on inflation

- 840 cranes operating nationwide

- Resilient businesses remaining profitable

Read more below.

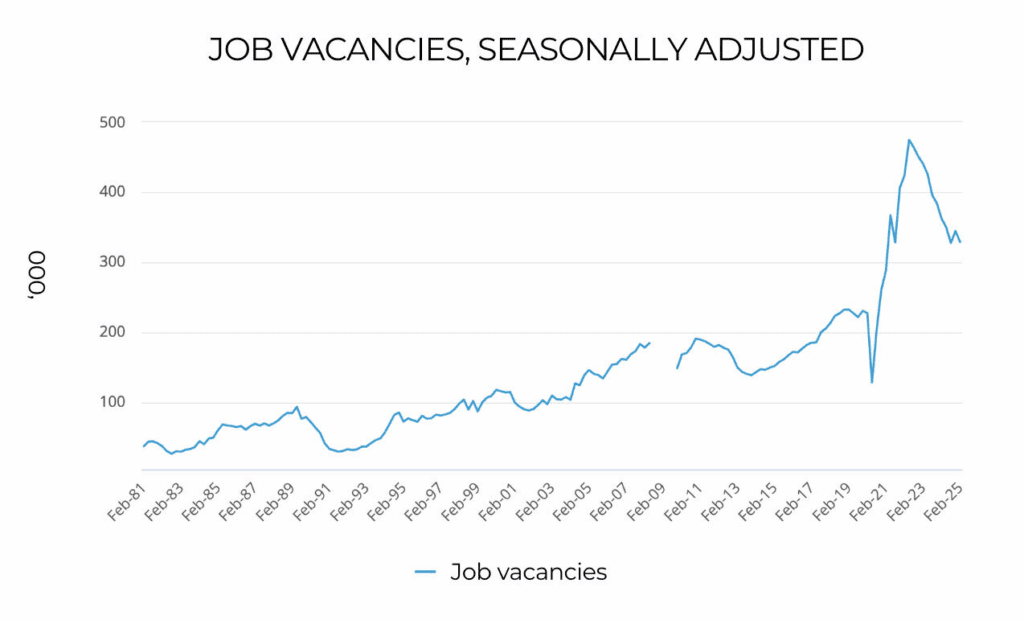

Job vacancies have now declined for 10 out of the last 11 quarters, according to the Australian Bureau of Statistics (ABS).

Vacancies peaked at a record 474,700 in May 2022, but have since fallen to 328,900 in February 2025, a reduction of 30.7%.

“However, despite the falls in job vacancies over the last two and a half years, the total number of vacancies was still 44.5% higher than before the COVID-19 pandemic in 2020,” said the ABS’s head of labour statistics, Sean Crick.

“The December quarter [labour data] continues to show strong demand for people, with vacancies still tracking at around 2.1% of all jobs in Australia. This was unchanged from the previous quarter and was higher than the pre-pandemic rate of 1.6%.”

In other words, while recruitment has become easier for employers than in the recent past, it remains challenging. With that in mind, here are five tips to help you find quality staff:

- Write clear, engaging job ads to attract the right candidates

- Offer competitive pay and benefits to stand out from other employers

- Include a salary range in job ads, as applicants value transparency

- Act quickly – good candidates are often snapped up fast

- Be flexible with work arrangements to appeal to a wider talent pool

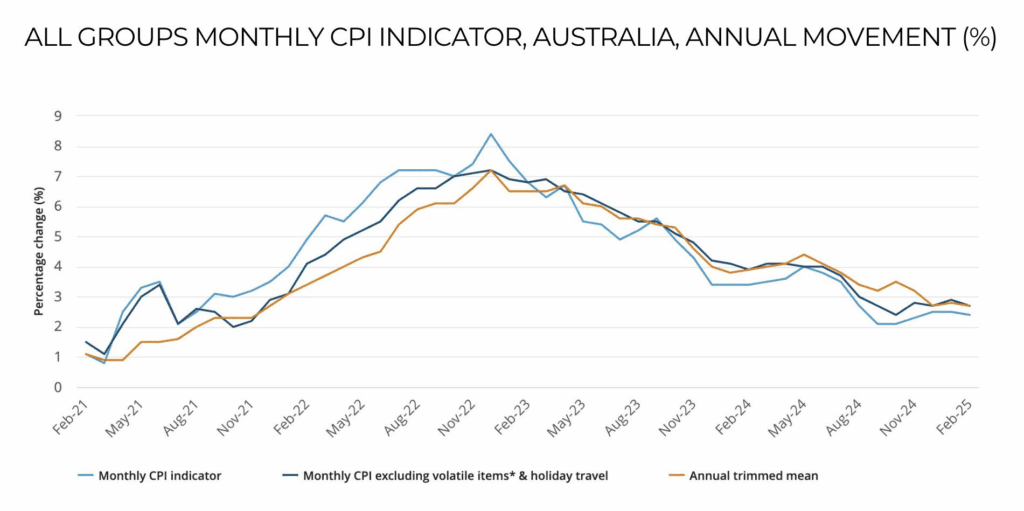

The economy has made significant improvement on inflation over the past year, based on the latest data from the Australian Bureau of Statistics.

The headline inflation rate has fallen from an annualised rate of 3.4% in February 2024 to 2.4% in February 2025, while the trimmed mean inflation rate has fallen from 3.9% to 2.7%.

Headline inflation has been within the Reserve Bank of Australia’s target range of 2-3% for seven consecutive months and trimmed mean inflation for three consecutive months. (The central bank regards the trimmed mean rate as more accurate, as it excludes items with volatile price movements from inflation calculations.)

However, the Reserve Bank acknowledged that “uncertainty about the United States’ international trade policies”, and subsequent reactions from other countries, “could have a chilling effect on business investment and household spending decisions, and pose substantial headwinds to the outlook for global economic activity and inflation”. As a result, the outlook for inflation over the coming months is uncertain.

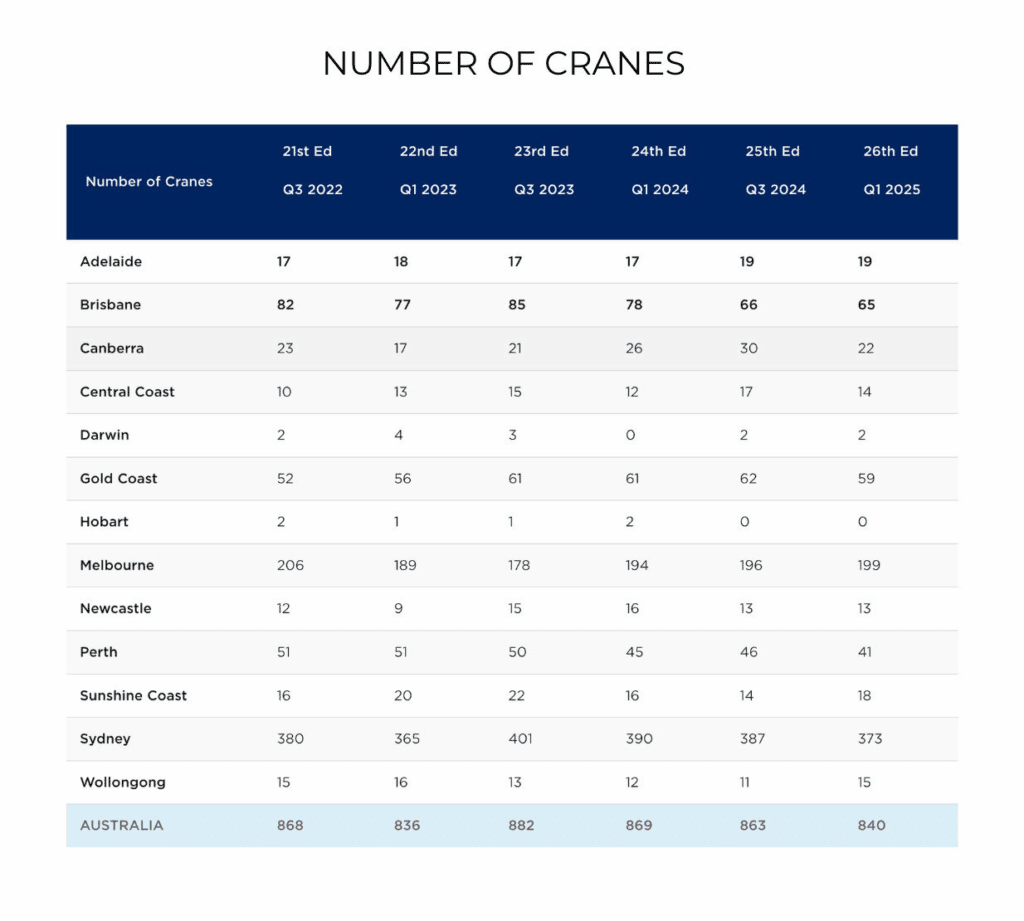

Construction crane numbers remain strong across Australia, despite a recent dip in building activity, according to multinational construction group RLB.

RLB counted 840 cranes operating nationwide during the first quarter of 2025 – continuing the streak of 800-plus results that started in the first quarter of 2022. However, numbers were lower than six months ago (863), 12 months ago (869) and 18 months ago (882).

Sydney was home to 44% of the nation’s construction cranes in the March 2025 quarter and Melbourne 24%. Of the remaining cranes, 8% were in Brisbane, 7% the Gold Coast and 5% Perth, with the other 12% scattered around other locations.

If you’re planning to construct a commercial building, work closely with your architect and builder to finalise design, timelines and approvals. Make sure you’re across zoning laws and local council requirements – these can impact what you’re allowed to build and how long it will take.

Also, set a clear budget, which should factor in unexpected costs and delays.

Finally, please consult me early in the process. I can help you explore your funding options, structure your finance efficiently and ensure you’re well-placed to move forward when construction begins.

Contact me to secure development finance

“Most businesses remain profitable, despite the ongoing pressures,” the Reserve Bank of Australia (RBA) has reported in its latest Financial Stability Review.

“Most large and small businesses’ profit margins are around the level recorded over the 2010s, although our measure for small businesses is only available to the September quarter 2024 and surveys suggest that these businesses have faced increased pressure on their profitability since then. Additional measures – such as the share of businesses experiencing growth in profits or conversely making losses over the past year – are also around the average of the 2010s.”

The RBA’s research found that many businesses have struggled to pass on higher costs to customers and have therefore resorted to cost-cutting to remain profitable.

However, many businesses have achieved sufficient revenue growth to offset increased labour and non-labour costs over the past year or so.

“Most businesses have maintained robust balance sheets, providing an important source of resilience. Businesses’ ongoing profitability has allowed them to avoid depleting their cash holdings or taking on additional debt to manage cash flow pressures,” the RBA said.

Contact me to discuss your business finance options

Thanks for reading. Please get in touch if you want to purchase an asset or refinance a loan before the end of the financial year.