We got an interesting mix of news for your this month, covering commercial property, the economy, the vehicle market and superannuation:

- Commercial property trends

- Unemployment may be near peak

- Car delivery times at 65 days

- ATO issues super reminder

Read more below.

One of Australia’s leading commercial property experts has identified five trends that are likely to play out over the rest of 2024.

The first trend is a retail resurgence, according to Ray White Group Head of Research Vanessa Rader. This will be driven by population growth and limited new construction, which will increase demand for quality retail space.

Second, there will be emerging opportunities in the office sector. “The increasing yields in this sector offer attractive prospects for those with a long-term investment horizon or those willing to undertake redevelopment or renovation projects during the current cycle, positioning themselves for an anticipated upturn in office occupancy in the coming years,” she said.

The third trend Ms Rader identified was sustained demand for assets under $10 million, as a lot of owner-occupiers and investors would be competing for these properties.

Fourth, we can expect more major property development activity, “fueled by a nationwide housing shortage that continues to bolster both property prices and rental rates”.

The fifth trend, according to Ms Rader, is that more new investors will enter the market, with the support of buyer’s agents.

I CAN HELP YOU GET A COMMERCIAL LOAN

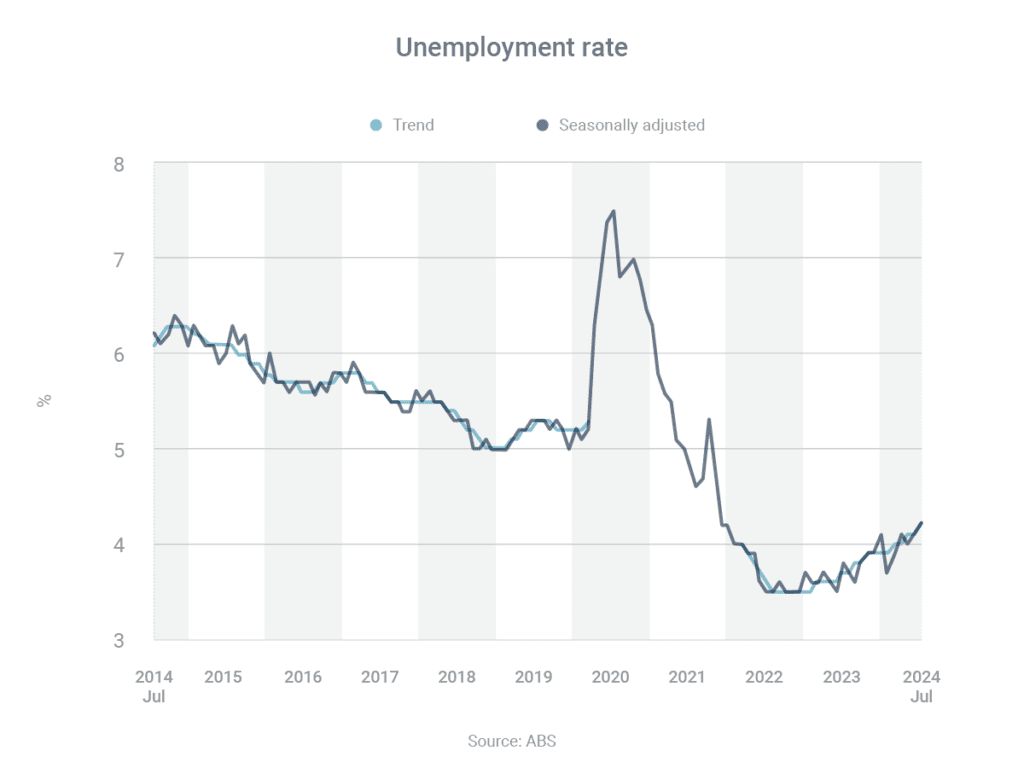

The unemployment rate has continued to creep up, reaching 4.2% in July, compared to just 3.7% in February, according to the Australian Bureau of Statistics (ABS).

However, the Reserve Bank of Australia (RBA) doesn’t expect it to rise much further, forecasting that the unemployment rate will be 4.3% at the end of this year and 4.4% at the end of next year.

“The participation rate remains strong and average hours worked have proven resilient. Job vacancies have come down, but they are still higher than before the pandemic,” according to the RBA.

“The unemployment rate is expected to keep slowly rising until early 2025 but the expected recovery in GDP growth should continue to support demand for labour.”

The economy grew by an annualised rate of just 1.1% in the March quarter, based on the latest ABS data, and the RBA expects growth to fall to 0.9% in the June quarter. However, growth is expected to rise to 1.7% by December 2024 and 2.5% by December 2025 – which is likely to lead to greater business profitability and an increased demand for labour.

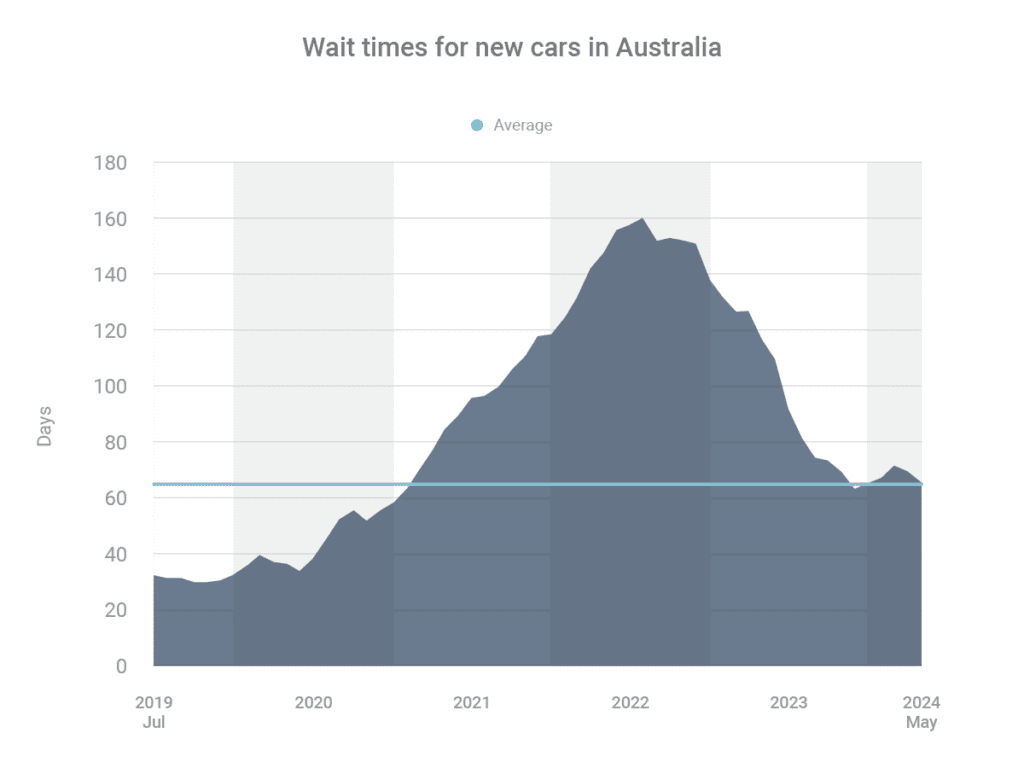

If your business is planning to invest in a company car, there are three main things to think about when you do your research – the price of the vehicle, the reliability of the vehicle and the amount of time you’ll need to wait to receive the vehicle.

That’s because there’s just as much variability around waiting times as price and reliability.

The average waiting time for a new car in June was 65 days, according to the latest data from Price May Car. But it was significantly longer for some vehicles, including the Toyota Hiace (278 days), Toyota Corolla (216 days), Hyundai Staria (133 days), Ford Everest (127 days) and Suzuki Jimny (119 days).

By contrast, some vehicles had short waiting times, such as the Subaru Impreza (15 days), Subaru Forester (16 days), Mazda CX-5 (19 days), Hyundai Tucson and Volkswagen T-ROC (both 21 days).

Please contact me before you start searching for a vehicle, so I can compare the market and organise a pre-approval. That way, you’ll get a good deal and know your budget.

CONTACT ME IF YOU NEED A COMPANY CAR

The first superannuation guarantee (SG) payment of the 2024-25 financial year is due on 28 October, as it is every year.

Thereafter, payments are due on 28 January, 28 April and 28 July, as per normal.

The Australian Taxation Office (ATO) has urged businesses not to miss these deadlines.

“The ATO takes non-payment of SG seriously,” it said. If you miss a deadline, “even by a day”, you must pay the super guarantee charge (SGC) to the ATO and lodge an SGC statement within one month of the SG deadline.

The SGC is not tax-deductible and is more than the super that was supposed to be paid.

One common reason businesses are slapped with an SGC is because their super payments don’t reach their employees on time.

“Remember, if you use a commercial clearing house, you need to allow time for payments to reach your employee’s super fund by the due date,” the ATO said. “The due date is the date payments are received by the super fund, not the clearing house.”

As your broker, I’m able to assist you with business finance, commercial property finance and asset finance. Contact me to discuss your scenario.